Startup and growth companies face a number of complex challenges when turning great ideas into scalable, investable businesses

Sky Valley Advisors helps companies raise capital, navigate strategic decisions, and prepare for IPO or exit.

Our Focus Areas

-

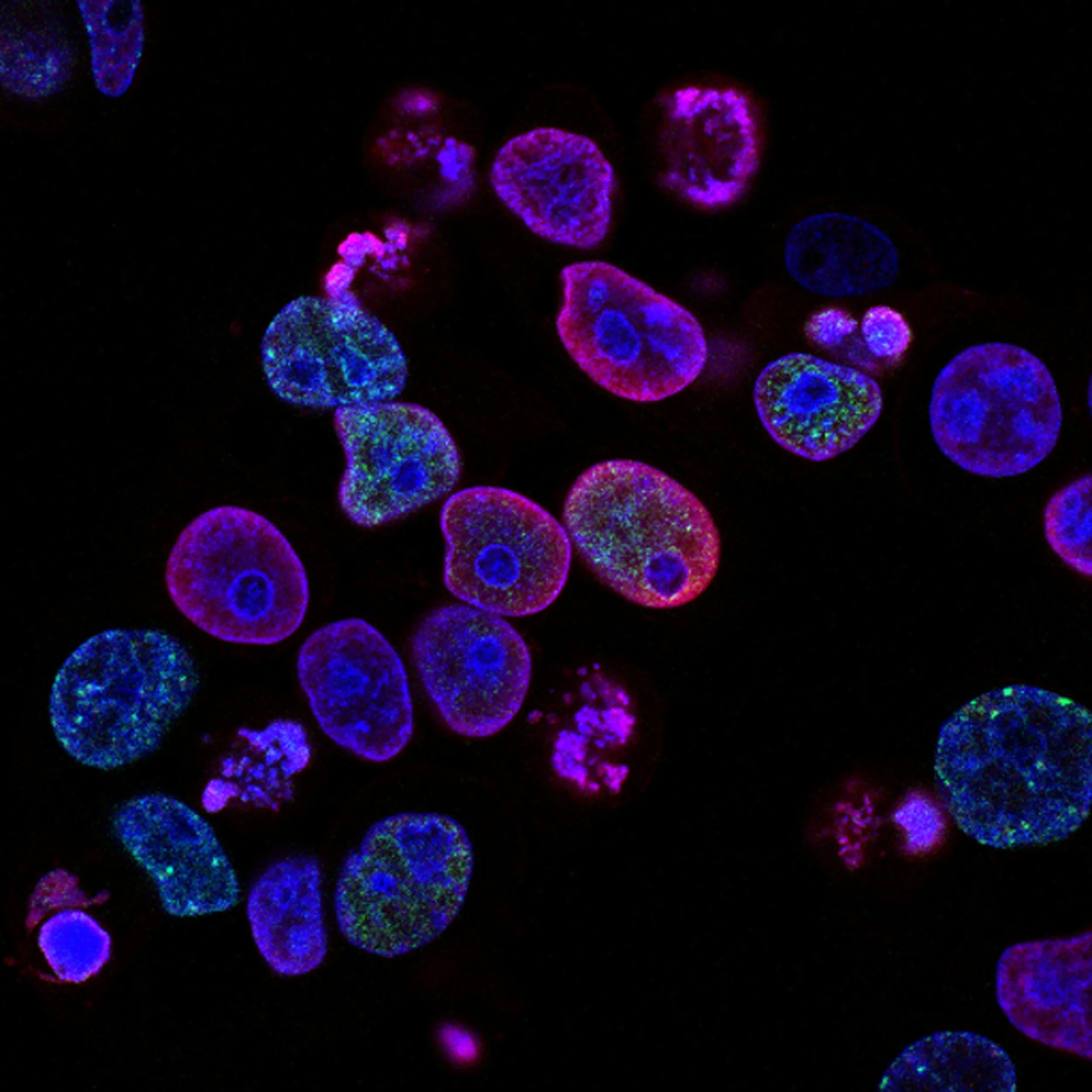

Biotech / Life Sciences

Our deep experience with biotech and academic medicine allows us to translate scientific and medical concepts into operational and capital requirements needed to reach the key milestones

-

AI-native / Tech-enabled Companies

With our experience in AI-native and tech-enabled companies in biotech, health, and finance, we are able to cross multiple sectors to assist in capital raises needed to support rapid growth such as AI drug discovery

-

Private Equity / Venture Capital

For portfolio companies, we provide the expertise and experience to ensure that investments achieve intended objectives and outcomes

Services

Our proven framework maximizes results and drives sustainable outcomes.

As both advisors and operators, who have extensive deal and management experience, we improve your corporate functions to make sure the business can support the raise and minimize impact to operations.

-

We provide advisory support to ensure that strategic objectives, operational plans, and financing needs are fully aligned.

By validating the underlying strategic drivers and stress-testing the execution roadmap, we help clients articulate a clear, investable thesis that resonates with internal stakeholders and external investors.

-

We support clients in developing robust, forward-looking financial models and performance dashboards to enable data-driven decision-making.

Our work focuses on forecasting cash flow, optimizing resource allocation, and ensuring alignment between capital deployment and strategic objectives—particularly in relation to use-of-proceeds planning.

This allows leadership teams to anticipate funding needs, manage burn rates, and communicate clearly with investors.

-

We advise clients on building or validating robust pro forma models to assess internal valuations, revenue potential, and key performance metrics.

Our business case modeling provides a fact base to inform critical decisions, ranging from capital allocation to transaction structuring, to ensure alignment between strategic intent, financial outcomes, and deal parameters.

-

We provide end-to-end advisory support across the fundraising lifecycle. Our work includes establishing processes, setting up data rooms and reporting systems, and coordinating cross-functional teams to ensure a seamless investor experience.

-

We help clients articulate a compelling equity story and investment thesis, backed by key data, metrics, and analysis.

In the process, we also coordinate messaging and manage alignment with board members, insiders, and executives, to drive an efficient raise.

-

We advise clients on optimal deal structures and terms, drawing on experience across hundreds of transactions.

Our analysis benchmarks key provisions against market norms, identifies potential value or risk drivers, and supports negotiation strategies aligned with long-term objectives.

We help clients navigate complex terms to ensure alignment with strategic, financial, and governance priorities.

-

We advise clients on comprehensive preparation for public market entry through traditional IPOs or de-SPAC transactions.

Our approach encompasses strategic, operational, and financial readiness —aligning governance frameworks, investor communications, and compliance requirements to meet the rigorous demands of public markets.

We draw on deep IPO experience to guide leadership teams to position their companies for successful listing and sustained public market performance.

-

We help clients prioritize and plan the effective use of raised capital to maximize growth and ROI by helping Executives identify and execute on high-impact initiatives.

Meet the Team

-

Edward Tsai

Managing Partner

Management consultant specializing in advanced biotechnology and technology companies. Advised boards and executive leaders across technology / drug development from translational / pre-clinical research to clinical and commercial stage companies. Primarily focused in oncology, neurology, and cell therapies such as CAR-T and iPSC-based regenerative medicine.

-

Chase Feehan

Senior Advisor

Corporate finance specialist with a diverse array of professional expertise, including biotech/healthcare ECM investment banking in NYC, vast experience in financial modeling, pitch decks, and valuations in both private and public capital transactions. Numerous successful transactions and engagements.Participated in the execution of 100+ deals across multiple sectors.

-

Dawn Crandlemire

Senior Advisor

Investment Banker with 15+ years of experience partnering with Senior Executives to drive growth, and operational excellence. Led over $20 billion in capital raises and M&A transactions in lead-left roles for high-growth, tech-enabled companies. Co-founded ventures across healthcare services bringing a builder’s mindset and cross-functional leadership to innovative, high-growth businesses.

Who We Are

We bring agility, creativity, and excellence to every client relationship by providing tailored, hands-on service with senior-level attention.

-

To partner closely with clients in order to shape and execute strategies to achieve consistent, sustainable growth and build resilient, high impact organizations.

-

To unlock potential, drive meaningful, lasting progress for companies and the people that represent them, and create value for the broader communities that these companies serve

-

Balanced

Integrity

Open-Mindedness

Focused Excellence